The Association of Muslim Schools UK (AMS UK) expresses deep concern following today’s High Court judgment which dismissed legal challenges against the introduction of VAT on independent school fees under a prospective Labour government policy.

The legal challenge—brought forward by families and supported by a range of organisations including Education Not Discrimination, Christian Concern and the Independent Schools Council (ISC)—was intended to protect children’s rights and ensure that access to education remains equitable and inclusive. While the Court acknowledged that children’s rights under Article 2 of Protocol 1 (right to education) and Article 14 (freedom from discrimination) had indeed been interfered with by this policy, the ruling upheld the government’s wide margin of discretion in pursuing taxation policies.

AMS UK notes the following key concerns highlighted in the judgment:

The court recognised the serious harm this policy will cause to children, especially those in faith schools and children with Special Educational Needs and Disabilities (SEND).

For Muslim pupils, the court ruled they do not constitute a sufficiently distinct group affected disproportionately. AMS UK strongly refutes this, as many Muslim independent schools serve disadvantaged communities and operate with minimal financial margins, often stepping in where local provision is lacking.

The court accepted that the SEND system is in a “parlous state”, yet found the lack of exemption for children without EHCPs was legally permissible.

The rejection of the argument that independent education is unprotected by the right to education is welcomed—this affirms the legal status of independent schools within the framework of the European Convention on Human Rights.

While the judgment is disappointing, it has underlined several important points.

AMS UK will continue to advocate for faith-based, inclusive, and high-quality education for all pupils, and will engage directly with government, political parties, and legal experts to ensure that:

Faith schools are not penalised for delivering community-anchored, culturally and religiously appropriate education.

SEND children in independent settings are not left behind, particularly those without formal EHCPs but with significant needs.

Parents and schools serving minority communities are protected from unintended but deeply damaging consequences of this tax.

AMS UK stands with the broader independent sector in urging the government and opposition to reconsider the blanket VAT policy on educational grounds, and to commit to a fairer, more inclusive approach that safeguards children’s futures across all sectors.

The No1 recruitment platform for Muslim schools.

The No1 recruitment platform for Muslim schools. Members and non-members can select from two listing types – standard and premium.

Members and non-members can select from two listing types – standard and premium.  Guide for employers on how to use register and post a job.

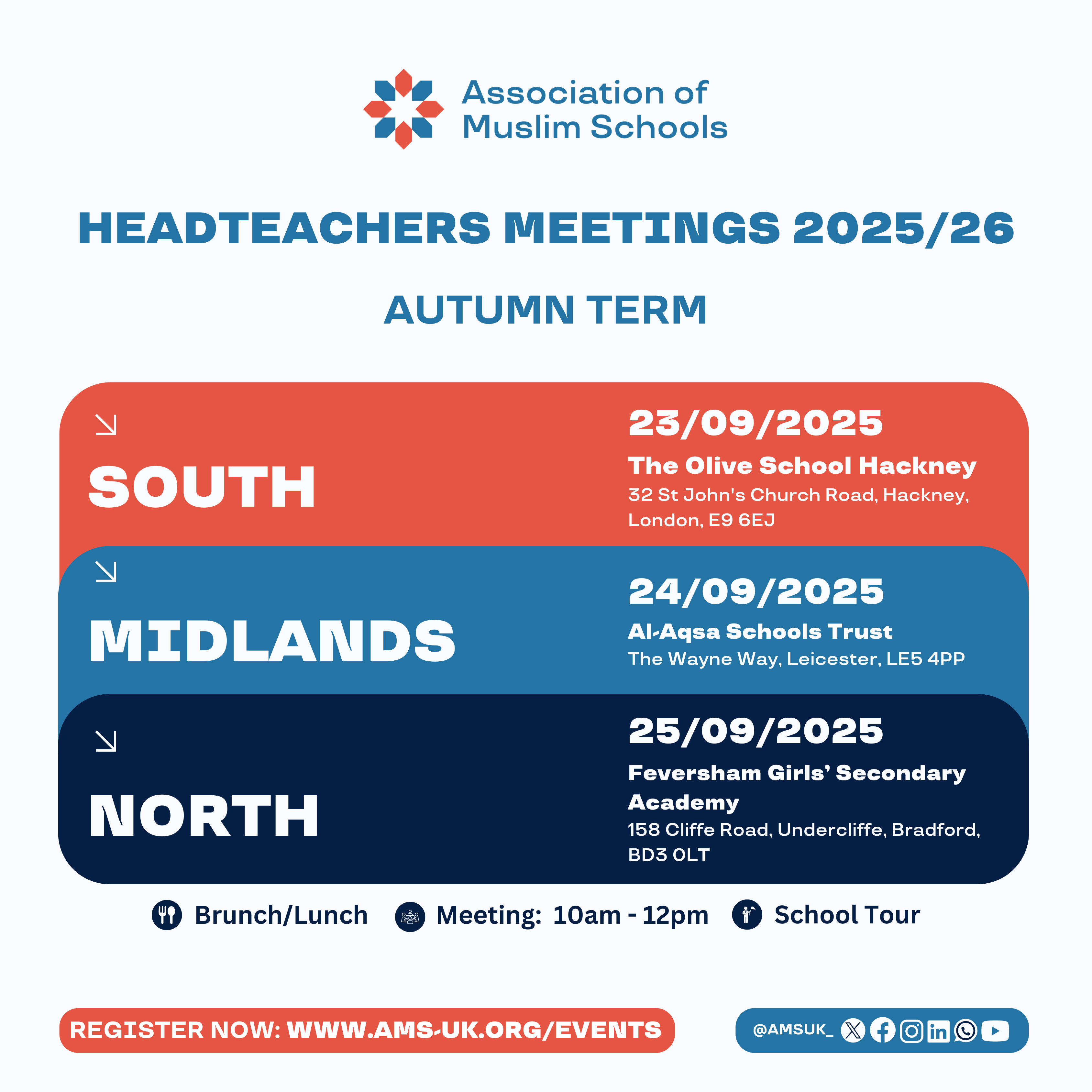

Guide for employers on how to use register and post a job. Join the AMS at our headteacher termly meetings across this academic year.

Registration is now open for our Autumn meetings.

Join the AMS at our headteacher termly meetings across this academic year.

Registration is now open for our Autumn meetings.  The AMS is leading the development of resources that can be used in the classroom to teach RSE, as well as support for leaders in meeting their statutory obligations; all within an Islamic context.

The AMS is leading the development of resources that can be used in the classroom to teach RSE, as well as support for leaders in meeting their statutory obligations; all within an Islamic context. The AMS has developed resources that will help schools to manage changes in the government’s education policies.

The AMS has developed resources that will help schools to manage changes in the government’s education policies. The independent schools council (ISC) have compiled a list of schools amongst their 1300+ members, which has a sixth form provision that offer bursaries. The list of schools is based on highly populated towns and cities that AMS members schools are situated.

The independent schools council (ISC) have compiled a list of schools amongst their 1300+ members, which has a sixth form provision that offer bursaries. The list of schools is based on highly populated towns and cities that AMS members schools are situated.